Videos

Learn More About Andrew W. Lo

Is it irrational to assume that markets behave rationally? This seemingly obvious question prompted renowned MIT economist Andrew Lo to rethink the efficient markets hypothesis, a cornerstone of modern financial theory that is often disputed. Seeking to reconcile human behavior with market efficiency, he was led down an unexpected path to studying behavioral finance, psychology, cognitive neurosciences, artificial intelligence, bounded rationality and, ultimately, evolutionary biology and ecology.

In his acclaimed book “Adaptive Markets: Financial Evolution at the Speed of Thought” (Princeton University Press, May 2017), Lo shares the groundbreaking framework that emerged from his deep research, which explains how markets and financial institutions adapt to changing environments just like living species do.

“The Efficient Markets Hypothesis assumes that prices fully reflect all available information. But as we now know there’s a wide gulf between human behaviors on one end of the spectrum and efficient markets on the other. This debate has been a tremendous source of friction between industry and academia,” explains Lo, a widely respected financial scholar whose latest book, “In Pursuit of the Perfect Portfolio: The Stories, Voices, and Key Insights of the Pioneers Who Shaped the Way We Invest” (Princeton University Press, August 2021), gives readers an inside look at the lives of ten of the most prominent figures in the finance world. “The Adaptive Markets Hypothesis is meant to reconcile these two schools of thought in a framework that allows both to reflect their incredibly important contributions to what we experience in the real world.”

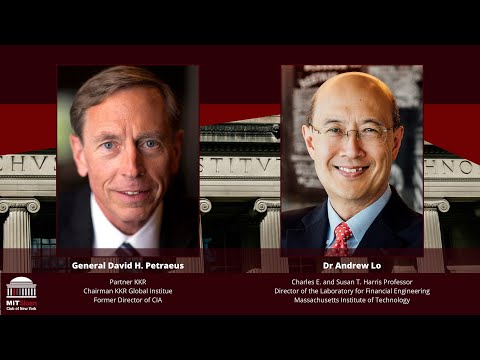

The Charles E. and Susan T. Harris Professor at the MIT Sloan School of Management who was named one of World’s 100 Most Influential People” by TIME, Lo is a sought-after advisor, speaker and educator. Director of MIT’s Laboratory for Financial Engineering, his work centers on helping organizations in every sector — including his own — more precisely measure potential outcomes, even in areas where mathematics is not traditionally used. Inspired by his own family struggles with access to cancer treatments, Lo is particularly focused on bridging the gap between science and finance by helping health care institutions, drug companies, and biotech founders improve patient outcomes as well as their bottom lines.

“For the last 10 years, I’ve become increasingly convinced that finance is both misunderstood and misused in many contexts,” explains Lo, who is also a research associate for the National Bureau of Economic Research and sits on the boards of several major corporations. “That’s one of the reasons why we have bad outcomes, as in the 2008 financial crisis, and as we see in industries like health care. The pandemic offered us a new way to look at financial markets and an opportunity to prepare for the future.”

Lo is equally passionate about showing companies that it is possible to “do well by doing good,” emphasizing that finance can be tremendously powerful when used properly, but it can also be a dangerous weapon if incorrectly applied. His framework for determining the correlation between impact investing and individual stock performance illustrates how financial engineering can help solve big problems like climate change, chronic diseases and future pandemics. He also co-developed socially responsible investing (SRI) and environmental, social and governance (ESG) frameworks that can be applied to institutional portfolios.

“In investing, as in evolutionary biology, people are motivated by self-interest and they make mistakes, but they adapt and learn from them,” Lo adds. “Looking at financial markets as an ecosystem allows us to understand the relationship between investment performance and various types of investor behaviors. We may not be able to time the market day to day, but we can certainly identify behavioral trends over longer holding periods.”

###

Andrew W. Lo is founder of AlphaSimplex, an asset management company, BridgeBio Pharma, a biotechnology company focused on developing therapies for genetic diseases, and QLS Advisors, a health care analytics and advisory company focused on applying data science and artificial intelligence to managing biomedical portfolios. He has published numerous articles in finance and economics journals, authored several books and won numerous awards and fellowships for his teaching, writing and research. He serves as a board member, director or advisor to several prestigious organizations. He received a B.A. in economics from Yale University, an A.M. and Ph.D. in economics from Harvard University, and he was an assistant and associate professor of finance at the University of Pennsylvania’s Wharton School from 1984 until 1988, when he joined MIT.

Andrew W. Lo is available to advise your organization via virtual and in-person consulting meetings, interactive workshops and customized keynotes through the exclusive representation of Stern Speakers & Advisors, a division of Stern Strategy Group®.

In Pursuit of the Perfect Portfolio: Key Insights From Investment Rock Stars

Is it possible to build an ideal portfolio, one that perfectly balances risk and reward? In this talk, world-renowned MIT economist and financial scholar Andrew Lo, director of the MIT Laboratory for Financial Engineering, shares profound insights he learned from the world’s most prominent figures in the finance world, whom he profiled in his latest book “In Pursuit of the Perfect Portfolio.” He covers such areas as effective diversification, passive versus active investment, security selection and market timing, foreign versus domestic investments, derivative securities, nontraditional assets, irrational investing, and more. Acknowledging that the perfect portfolio is ultimately a moving target based on individual age and stage in life, market conditions, and short- and long-term goals, he explains why the fundamental principles for success remain constant in spite of changing market conditions.

ESG and SRI Metrics: Measuring the Rewards and Costs of Impact Investing

“Finance can be tremendously powerful when used properly, but it can be a dangerous weapon if incorrectly applied,” warns world-renowned MIT economist and financial scholar Andrew Lo, director of the MIT Laboratory for Financial Engineering. Drawing from his deep research, he discusses his framework for quantitatively measuring the financial reward, or cost, of impact investing, including socially responsible investing (SRI) and environmental, social and governance (ESG) issues. Using real world examples, he illustrates how the framework can be applied in such diverse areas as biotech venture philanthropy, “sin” stocks, ESG and “meme” stocks like GameStop.

Improving Health Care by Letting Science Drive Investment, Not Vice Versa

Nonprofits routinely shoulder the burden of raising funds to fight diseases like cancer and many other life-altering or life-threatening diseases. But what drives corporate investment in potential cures? Profit or purpose? Drawing from his ongoing research, world-renowned MIT economist and financial scholar Andrew Lo, director of the MIT Laboratory for Financial Engineering, discusses the most pressing medical challenges of our time, why so many potential innovations and cures lack funding, and the ethics of drug pricing policies. Inspired by his own family struggles with gaining access to cancer treatments, he highlights the urgent need to bridge the gap between science and finance and explains how health care institutions, drug companies, vaccine makers and biotech founders can improve patient outcomes as well as their bottom lines by letting science drive investment—not vice versa—so that everybody wins.

Healthcare Finance: Modern Financial Analysis for Accelerating Biomedical Innovation

(Princeton University Press, November 2022)

In Pursuit of the Perfect Portfolio: The Stories, Voices, and Key Insights of the Pioneers Who Shaped the Way We Invest

(Princeton University Press, August 2021)

The Evolution of Technical Analysis: Financial Prediction from Babylonian Tablets to Bloomberg Terminals

(Bloomberg Press, August 2010)

Hedge Funds: An Analytic Perspective (New Edition): An Analytic Perspective

(Princeton University Press, July 2010)

The Heretics of Finance: Conversations with Leading Practitioners of Technical Analysis

(Bloomberg Press, January 2009)

From ELIZA to ChatGPT: The Evolution of Natural Language Processing and Financial Applications

(The Journal of Portfolio Management, July 2023)

Deep-Learning Models for Forecasting Financial Risk Premia and Their Interpretations

(Quantitative Finance, May 2023)

The Wisdom of Crowds Versus the Madness of Mobs: An Evolutionary Model of Bias, Polarization, and Other Challenges to Collective Intelligence

(Collective Intelligence, September 2022)

The Industrial Organization and Regulation of the Securities Industry (National Bureau of Economic Research Conference Report)

(University of Chicago Press, April 2008)

Dynamic Asset-Pricing Models (International Library of Financial Econometrics)

(Edward Elgar Publications, June 2007)

Praise for “In Pursuit”

“What if you could get inside the minds of some of the greatest investors in history? It would be nice if you had a window straight into their heads, but in reality it would take years of hard work to learn to think the way they do. . . . Or, you could simply read. . . . In Pursuit of the Perfect Portfolio. “

“A good look at the development of portfolio theory, starting with Markowitz.”

“This is a delightfully written account of the finance pioneers who have shaped our understanding of how to build optimal investment portfolios. Masterfully illuminating the lives and wisdom of Nobel Laureates and important investment professionals, In Pursuit of the Perfect Portfolio offers provocative insights for academics and practitioners.”

“Throughout recorded history, people have looked to safeguard their future through the stewardship of their assets. This wonderful book describes how, in the twentieth century, a group of scholars and practitioners developed systematic approaches to this endeavor. By exploring the differences between these pioneers, In Pursuit of the Perfect Portfolio puts forth a framework that enables each of us to reflect on our own investment portfolios.”

“Ever wonder if there is a better way to invest? In Pursuit of the Perfect Portfolio does a marvelous job setting out answers by taking readers through the evolution of modern investment management. Combining interesting anecdotes with fulsome explanations, the authors provide a roadmap for how portfolio selection has developed. Accessible to new and experienced investors, this book makes clear that the search for the perfect portfolio is an engaging and never-ending quest.”

“Lo and Foerster tell the stories of ten innovators that helped to produce a revolution in the investing field these past fifty years. The authors delve into the personal histories of these individuals and explain how their innovations have improved investment experiences for millions of investors, big and small. This entertaining book gives a great overview of the development of modern finance.”

“Lo and Foerster construct a ‘perfect portfolio’ of intimate biographies and divergent yet complementary ideas that will inform today’s most thoughtful investors. Not only does this book help individuals determine what approach would best suit them, it also offers institutions a tantalizing blueprint for better personalized investment solutions.”

“Lo and Foerster have produced an essential book on investing. Everyone should read In Pursuit of the Perfect Portfolio to find out what featured Nobel Laureates and investment thought leaders have to say about choosing the right portfolio mix. The authors do a splendid job of explaining in nontechnical language the similarities and differences in approach among those profiled.”

“This highly rewarding book walks us through the foundations of modern portfolio theory and incorporates the powerful insights of the practitioners who helped make it all happen. A perfect read!”

Praise for “Adaptive Markets”

- Winner - 2018 PROSE Award for Excellence in Social Sciences, Association of American Publishers

- Winner - 2018 PROSE Award for Business, Finance & Management, Association of American Publishers

- Finalist - 2017 TIAA Paul A. Samuelson Award, TIAA Institute

- Shortlisted - 2017 Financial Times and McKinsey Business Book of the Year Award

- CNBC - 13 Best Business Books of 2017

- Foreign Affairs - Best of Books 2017 – Economic, Social, and Environment / Finance

- The New York Times Deal Book - Business Books Worth Reading 2017

- Exame - 9 Books That Will Help You Get Rich in 2018

- MoneyWeek - Five of the Best Books of 2017

- Wall Street Journal - What Business Leaders Read in 2017

- Microsoft - Best Business Books of 2017

- Financial Times - Best Books of 2017: Economics

- Bloomberg - Best Books of 2017

“Mr. Lo’s book offers a unique way to think about the idea of ‘efficient markets’–a new hypothesis worth considering about how markets can be rational and irrational at the same time.”

“Mr. Lo makes a convincing argument and he also uses the book to lay out some interesting ideas–such as a huge, diversified fund that would invest in a range of potential cancer treatments.”

“[A] remarkable new book. . . . Lo’s book will be read and read widely. . . . His insights should allow investors and regulators alike to manage risks better. They should read it.”

“[Adaptive Markets is] a fascinating read, cogently situating financial behaviour within what we know about human behaviour and evolutionary history.” (Nature)

“Andrew Lo’s Adaptive Markets is a masterly synthesis of the traditional, rationality-based approach and new approaches based on psychology and neuroscience, evolutionary theory, and techniques such as computer simulations and artificial intelligence.” (Project Syndicate)

“This new book will become another essential read for anybody interested in financial markets. . . . [It] is a thoroughly interesting and enjoyable read. It is not technical, the explanations are super-clear, and there is some excellent story telling.”

“[Lo] has a knack for providing a telling anecdote or story to illustrate his point. More important, he also avoids being condescending or triumphalist.”

“Using research in evolutionary biology, psychology, neuroscience and artificial intelligence, Mr. Lo . . . explains how human behavior shapes the markets, leading to swings between stability and instability, profit and loss, innovation and regulation.”

“Andrew Lo’s ambitious book offers a welcome, fresh look at how financial markets work and why they sometimes fail. . . . Adaptive Markets makes a valuable and welcome contribution, rewarding the reader by broadening and improving our understanding of finance and markets–in stable and unstable times.”

“The financial markets we create similarly reflect ‘principles of evolution–competition, innovation, reproduction and adaptation’. In this important book, Lo of the Massachusetts Institute of Technology demonstrates the radical implications of this insight.

“[Adaptive Markets] is a summation of developments in fields ranging from economics and behavioral finance to neuroscience and artificial intelligence–all influences on the adaptive markets hypothesis Lo proposes as a framework for finance that considers both rational and irrational behavior.”

“By reading Adaptive Markets, investors and their advisors will benefit from a better understanding of the reasons, based in biology and human nature, that the market is not efficient.”

“Lo’s new book is a fascinating exploration of the evolution of financial innovation. It’s filled with fascinating stories of what drives human behavior and, ultimately, markets.”

“[Adaptive Markets] doubles as a kind of intellectual history of the global financial system and the innovations that have shaped it. . . . The book abounds with interesting anecdotes drawn from many fields, including the author’s own experiences.”

“A new theory should be able to capture all that its predecessors have to offer while adding new features. Lo’s adaptive-markets hypothesis is just such a replacement. . . . This book is essential reading.”

“Lo writes beautifully, and the book reads quickly. . . . Powerful, ageless, memorable, and fun.”

“When Lo writes, investors should listen. . . . I have never before read a book with so many memorable quotes that enrich its content and meaning.”

“Andrew Lo combines wonderfully broad scholarship and a delightfully instructive style to present dramatically new perspectives on how markets work and how they can be regulated more effectively. This important book will teach and entertain, and should influence those charged with keeping markets healthy.”

“Adaptive Markets will appeal to anyone who distrusts dogmatic economic theories and thirsts for a coherent view of how market economies produce both great gain and great pain for societies. Andrew Lo integrates a deep understanding of finance with a broad knowledge of biology, psychology, and ethics to offer a tantalizing vision of how financial engineering could become a powerful force for a more just, healthy, and prosperous world.”

“We tell stories, we learn from them, and we make them up. In this magnificent book, Andrew Lo explains how our attraction to stories drives markets, explains past catastrophes, and suggests future opportunities for world-saving financial engineering. And he packages it all in fascinating stories of his own.”

“Andrew Lo is a brilliant financial economist, visionary innovator, bold contrarian, gifted writer, and an unrelenting idealist. These traits are evident in this wonderful book, which traces the ‘evolutionary explosion of financial innovation’ that began with Vanguard’s creation of the first index mutual fund in 1974, tracking the S&P 500 Index. I continue to hold to index funds, but Dr. Lo’s book persuades me to keep a mind that is open―or at least ajar―to the new world of investment technology, investor preferences, and transaction efficiency, and to the wisdom of those who are smarter than I am.”

“This is a wonderful book. Andrew Lo traces a journey in which he reconsiders rationality in economics, moving from the efficient market hypothesis to his own Adaptive Markets Hypothesis through psychology, neuroscience, biology, and studies of financial innovations and crises. The book presents many valuable findings and is also full of emotion―enthusiasm, joy, frustration, and pain. It is itself a manifestation of the important finding that rational thinking and emotion go together.”